Keywords: Africa, Brazil, China, Cluster Policy, Government

Authors: Zhiting Wang, Carlos Tarrasón

Introduction

Cluster policy is a growing global phenomenon, addressing challenges that no actor can control unilaterally and providing platforms for collaboration. This article examines best practices in cluster policies for Portuguese-speaking countries in Africa including Angola, Cape Verde, Guinea Bissau, Mozambique, and Sao Tome e Principe, when compared to those undertaken by Brazil and China.

The article has four sections.The first section explains the development path and current situation of cluster policies in African Portuguese-speaking countries, Brazil and China, and summarizes their general development models. In the second section, we show typical examples of clusters in the areas of agriculture, industry, and technology in Cape Verde, Brazil, and China, comparing their policy continuity and financing model. In the third section, based on the previous comparison, we summarize the best practices in the two countries that can be useful for governments’ cluster development strategy in Portuguese-speaking African countries. The last section provides conclusions.

Cluster Policies in Portuguese-Speaking Countries in Africa, Brazil, and China

Although there is a global trend towards the development of clusters, it is not uniform throughout the world. Africa is still at an early stage with basic infrastructure building policies and international development support funds. Brazil began cluster policies in 2002, followed by a golden age for the emergence and growth of clusters during 2004-2011, after which the government oriented its cluster policies towards more horizontal strategies such as productivity and innovation. In China, the policies have maintained their continuity since the beginning of 2005, updating and progressively adding new priorities according to the designs of the central government.

Portuguese-Speaking African Countries

The current cluster policy models in Portuguese-speaking African countries have three characteristics in common: no national strategy design or are in the initial phase; mainly funded by exogenous financing and external aid; weak implementation of planning.

First, some Portuguese-speaking African countries do not include cluster development in their long-term strategies and national plans or are in the initial phase. Guinea-Bissau addresses value chain development with the Guinea-Bissau “Terra Ranka” 2025 Strategic and Operational Plan for strengthening cashew, rice, and livestock value chains. Mozambique also has never debated or implemented a specific policy on clusters, except the National Development Strategy (2015-2035) which mentions the creation of economic zones and industrial parks. Although Cape Verde has in the Growth and Poverty Reduction Strategy III (2012 – 2016), the cluster policy component is still in its infancy.

Second, most financing for cluster growth is exogenous with external assistance from International Financial Institutions (IFIs) or in a bilateral/multilateral cooperative way. According to a report by Pontes e Parcerias nos Países de Língua Portuguesa (P3lP) regarding the financing of the construction of the Water Cluster in Sao Tome and Principe, most sources come from international cooperation (such as Portugal, World Bank, European Union, European Investment Bank, ADB, BADEA, OFID, UNDP, UNICEF, among others), that is, more than 80% of the financing is guaranteed with external resources.

Second, most financing for cluster growth is exogenous with external assistance from International Financial Institutions (IFIs) or in a bilateral/multilateral cooperative way. According to a report by Pontes e Parcerias nos Países de Língua Portuguesa (P3lP) regarding the financing of the construction of the Water Cluster in Sao Tome and Principe, most sources come from international cooperation (such as Portugal, World Bank, European Union, European Investment Bank, ADB, BADEA, OFID, UNDP, UNICEF, among others), that is, more than 80% of the financing is guaranteed with external resources.

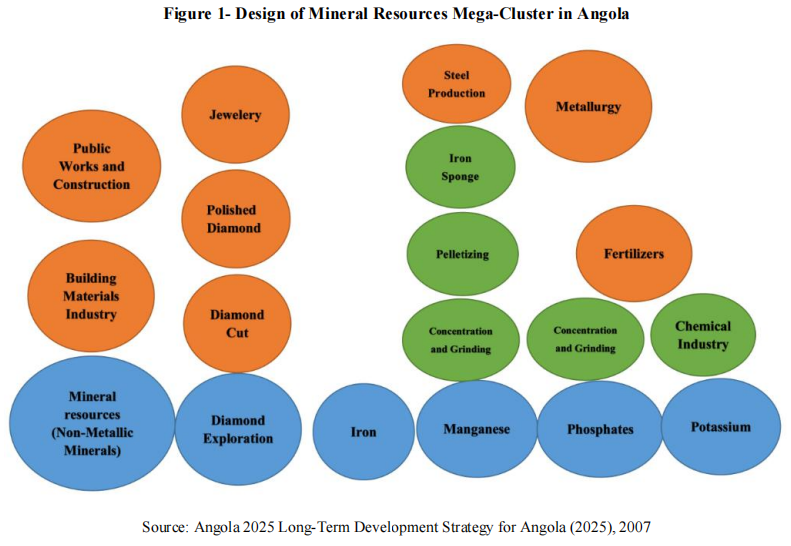

Third, some policies remain theoretical in the study which creates gaps between strategic planning and actual execution. This problem exists across Africa, but Angola is one of the most representative cases. In the Angola 2025 Long-Term Development Strategy for Angola (2025), the Angolan government illustrates a broad vision of economic development via clusters,  “A diversified economy will develop based on Clusters and Mega-Clusters of Mineral Resources, Oil and Natural Gas, Water, Forestry, Food, Habitat, Textiles, Clothing and Footwear, Tourism, Transport, and Logistics.” However, as of 2021, there has not been much progress.

“A diversified economy will develop based on Clusters and Mega-Clusters of Mineral Resources, Oil and Natural Gas, Water, Forestry, Food, Habitat, Textiles, Clothing and Footwear, Tourism, Transport, and Logistics.” However, as of 2021, there has not been much progress.

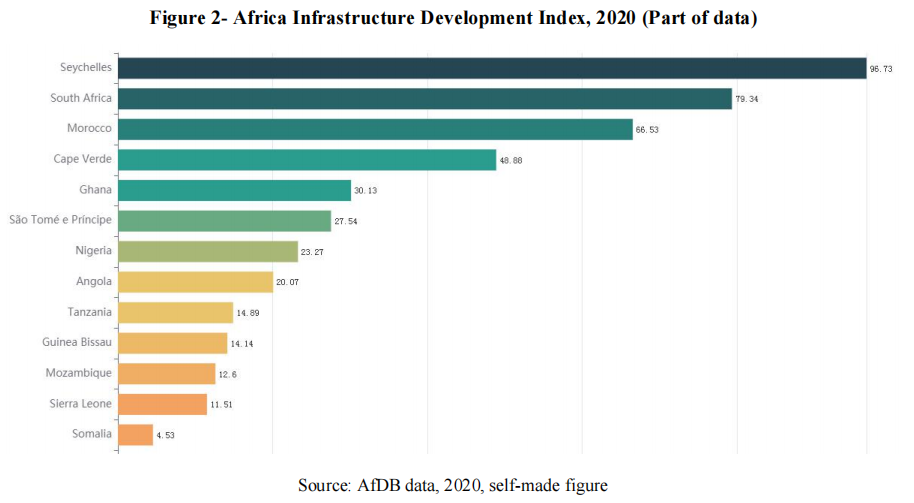

In addition to weaknesses in policy design, Portuguese-speaking African countries also face common problems that impede economic growth across the continent. The lag in infrastructure development hinders the industrialization process; the lack of regional economic integration makes it difficult to gain competitiveness; the drain of talent has led to a workforce lacking in management experience and a shortage of robust companies which are leaders in their industries and can drive the development of other micro and/or medium-sized firms.

Brazil

The path of development of Brazilian policies has had five phases: Beginning (2002); Ascension (2004); Continuation (2004-2008); Reinvention (2008); Change (2011-present). In 2002, the Brazilian government started to prepare the cluster policy by developing a new methodology and testing it in four projects together with the IDB and SEBRAE, starting to spread the concept of “cluster” (Local Productive Arrangements, LPAs). In 2004, the Ministry of Planning, Budget, and Management launched the 2004-2007 Pluriannual Plan which included the development of LPAs. Also in 2004, the MDIC led the creation of a permanent, multi-institutional working group to coordinate the different aspects of the policy, and every two years it holds a conference to discuss the progress. From 2007 onwards, the figure of the state nucleus was also created, which is the equivalent of the GTP APL in the States, fostering the decentralization of the policy.

The path of development of Brazilian policies has had five phases: Beginning (2002); Ascension (2004); Continuation (2004-2008); Reinvention (2008); Change (2011-present). In 2002, the Brazilian government started to prepare the cluster policy by developing a new methodology and testing it in four projects together with the IDB and SEBRAE, starting to spread the concept of “cluster” (Local Productive Arrangements, LPAs). In 2004, the Ministry of Planning, Budget, and Management launched the 2004-2007 Pluriannual Plan which included the development of LPAs. Also in 2004, the MDIC led the creation of a permanent, multi-institutional working group to coordinate the different aspects of the policy, and every two years it holds a conference to discuss the progress. From 2007 onwards, the figure of the state nucleus was also created, which is the equivalent of the GTP APL in the States, fostering the decentralization of the policy.

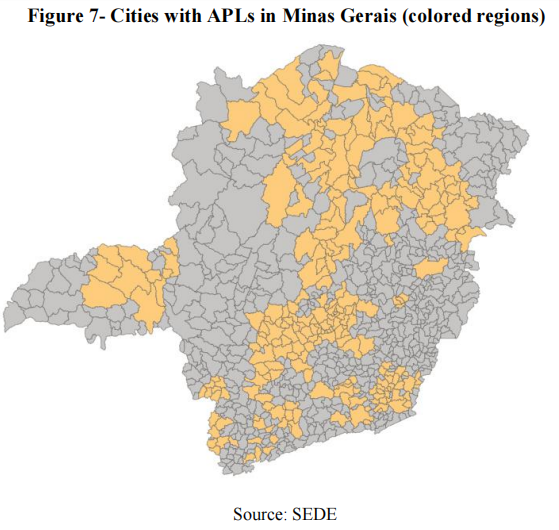

With the review of the methodology and the national program, between 2004 and 2008, the LPAs had the budgetary support of the ministry and the executional capacity of SEBRAE and other national economic development institutions. During that time, Brazil reached approximately 1,000 LPAs with an estimated total annual investment of USD 250 million. An evaluation of the policy took place in 2008, and in some cases the results were satisfactory and in others, they were not as expected. As a result, some institutions reinforced the policy, improving it, and others gave up and opted for other instruments. Then, in 2011, the new multi-year development plan Brasil Maior 2011-2014 was launched, with a strong focus on large production chains such as oil, gas, or automotive, leaving LPAs as a more social policy. From then on, there was no longer a specific policy on LPAs and the LPAs had to seek resources in national or state horizontal programs. In 2014 there were three national fronts: more social LPAs with the BNDES, agroindustrial LPAs led by the Ministry of Integration, and industrial LPAs supported by the Brasil mais Productivo program and executed by SEBRAE and SENAI. In addition to the overarching national policy, it should be mentioned that, given the size and complexity of Brazil, there were distinct plans in the various states and that, with financing from the IDB and the World Bank, they implemented their own cluster policies.

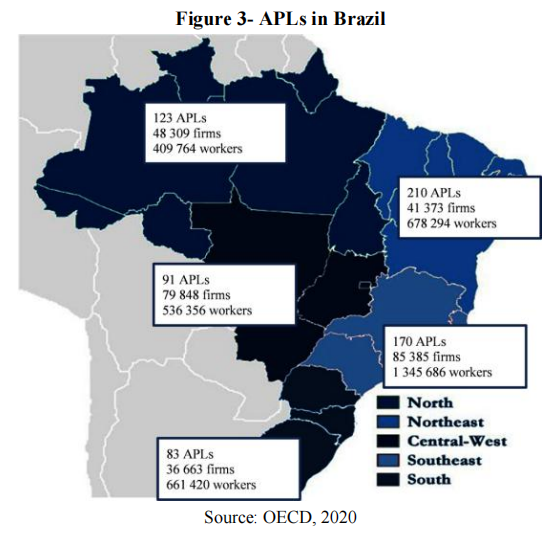

From 2011 to 2015 the number of LPAs formed in Brazil continued to grow, reaching 1,400, but decelerated, as many arose as a result of the states inducing the establishment of the LPAs through public notices and projects. They appeared naturally in the territory within this context and dissolved after the completion of the projects.

In 2018, with the election of a more liberal government, the Ministry of Development, Industry and Foreign Trade (MDIC) ended up being integrated into the Ministry of Economy. This government is less interventionist than the previous administrations, and the LPA policy is looking for a new path and maintaining itself with articulation activities and with a low budget. Recently there was a new registration of LPAs.

The LPAs policy model in Brazil has three characteristics. First, the pursuit of regional development is a great characteristic of Brazil. The federal government supports the LPAs that are decided by state governments based on economic reality. For example, the Southeast works more with industrialized LPAs, chains more focused on factories with labor, while the Midwest, Northeast, and North are more agro-industrial. Secondly, the policies are designed to collectively increase competitiveness, they will seek to “potentiate trends in production growth and entrepreneurship, raise productivity, improve existing comparative advantages and boost productive segments with the capacity to assert themselves internationally”. Thirdly, the federal government did not maintain the LPAs policy, but changed the focus to horizontal policies such as innovation and value chain methodology. Consequently, governments and state institutions that want to raise funds are turning to projects with different titles but within the same agglomeration of business. LPAs and value chains that are part of the same agglomeration lead to the LPA effect becoming ambiguous.

According to Coordinator Maria Cristina de A. C. Milani, “LPA policies are more effective than chain policies due to the local spillover to increase income and knowledge and this is more relevant for developing countries. Nevertheless, in Brazil, there was a time when the LPA policy was dismembered and direction was lost with increasingly isolated actions.”

China

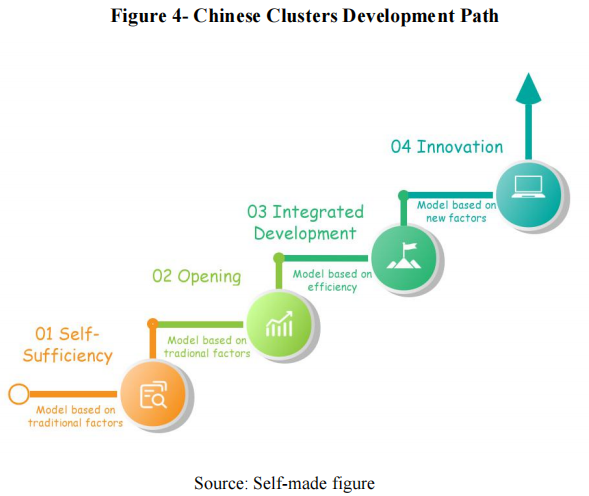

The path of Chinese policy development has progressed through four steps: Self-sufficiency; Opening; Integrated Development; Innovation. Due to China’s uneven regional economic development, clusters of each of the four phases exist at the same time.

The path of Chinese policy development has progressed through four steps: Self-sufficiency; Opening; Integrated Development; Innovation. Due to China’s uneven regional economic development, clusters of each of the four phases exist at the same time.

The self-sufficiency stage depends mainly on the policy design and the resource advantages of the local factors of production. Agglomerations and industrial chains are led by robust companies based on foundational advantageous industries or depend on the specific advantageous resources of the region.

The opening stage depends on the integration of the global division of labor chains to form localized industrial clusters. At this stage, the main goals are to take advantage of location, labor, and land factors, actively introduce the main emerging international industries to establish themselves, and, at the same time, cultivate a group of local support companies and form industrial clusters.

The integrated development stage is efficiency-oriented, led by industrial upgrading and technological innovation. In the integrated development stage, local firms no longer only offer support services or homogeneous production to leading international corporations, but rely on technological innovation and industrial upgrading. In this way, local companies become the leaders of the cluster.

The innovation stage takes advantage of development opportunities brought by new technologies and elements such as mobile internet, big data, Internet of things (IoT), artificial intelligence, etc.

The innovation stage takes advantage of development opportunities brought by new technologies and elements such as mobile internet, big data, Internet of things (IoT), artificial intelligence, etc.

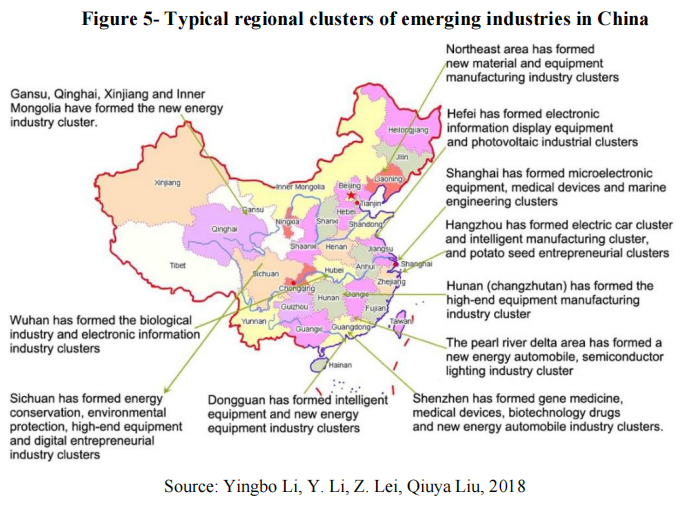

The cluster policy model in China has two characteristics of its own. First, cluster policies fixate on offering help to entities that perform well. For example, the Chinese government offers prizes and incentives to companies that have good results managing competition between companies and improving individual competitiveness. Then, these successfully maturing companies can promote the development of other small and micro-enterprises to finally reach the cluster effect. Second, the government maintains the continuity of the cluster-based policy, integrating it with horizontal policies such as traditional support policies for labor training, and new complementary policies with more current elements such as “Internet+”[ The support policies are like the National Plan for the Implementation of the Professional Education Reform which aims to supply talents and technicians. Complementary policies with new focuses and requirements as the long-term national strategy update and development such as China’s Five Year Plan.].

Examples of Clusters of Agriculture, Industry, Technology in Portuguese Speaking Countries in Africa, Brazil, and China

Cape Verde is the only Portuguese-speaking African country with the ongoing development of clusters, but they are only at the design and establishment stage. After decades of development, Brazil and China have created a series of clusters that are relatively mature in various sectors and reinforce the country’s economic development.

Cluster development in Cape Verde

In the agricultural sector, the Cape Verdean government is planning to establish an agribusiness cluster, inaugurating the São Lourenço dos Órgão Professional Training Center in Food Processing. In the industry sector, the government also launched a strategic plan to develop the Aero business cluster with ten priority intervention areas including passenger and cargo air transport, airports, hub and connectivity strategy, air navigation, handling, aeronautical maintenance and repair, training, regulatory framework, air agreements and synergies with other clusters. However, these two still do not work in the form of a cluster and are only in the infrastructure construction phase.

In the technology sector, there is currently a cooperation project between the African Development Bank (ADB) and the Cape Verdean Government (Operational Nucleus for the Information Society) to build an ICT cluster in Cape Verde. The project has a total commitment of USD 46,775,666 of which the ADB provides funding of USD 40,131,666 and the Cape Verdean government is responsible for the remaining USD 6,644,000. The project is still in the process of building the third data center and is not in use.

According to the plan, this ICT cluster aims to become a gateway to Africa in the field of information technologies, including the construction of business, incubation, certification, training centers, and a data center, with poles in the city of Praia and in Mindelo.

The expected impacts of this cluster are to promote the innovation ecosystem, create conditions for internationalization, attract foreign direct investment, improve development capacity, diversify business areas, and encourage the formation of talent. To make the objective and expected impacts easy, the Cape Verdean government also incorporates support policies including incentives for young start-ups and company financing, subsidies for professional internships, and some tax reduction.

The development of clusters in Brazil

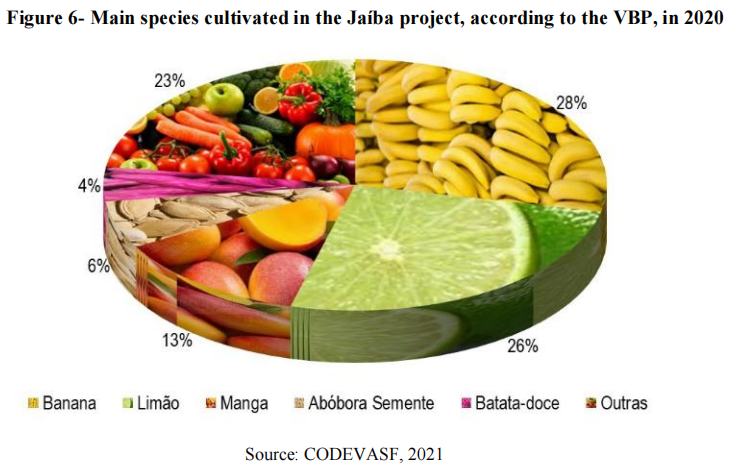

In the agriculture sector, the Jaíba Fruit Growing cluster in Minas Gerais can be a good example that represents the cluster's role in Brazilian agricultural development. The cooperative agencies and institutions are BID, the Government of Minas Gerais, IEL, SEBRAE, and ABANORTE. The highlights of the cluster are lemon, banana, and mango crops, which currently represent about 44% of the region’s irrigated area. The generation of 12,861 direct jobs, 19,292 indirect jobs, and 4,373 induced jobs, with a production of 218,201 tons of agricultural products and a VBP of USD 50,854,709 are predicted for 2021.

In the agriculture sector, the Jaíba Fruit Growing cluster in Minas Gerais can be a good example that represents the cluster's role in Brazilian agricultural development. The cooperative agencies and institutions are BID, the Government of Minas Gerais, IEL, SEBRAE, and ABANORTE. The highlights of the cluster are lemon, banana, and mango crops, which currently represent about 44% of the region’s irrigated area. The generation of 12,861 direct jobs, 19,292 indirect jobs, and 4,373 induced jobs, with a production of 218,201 tons of agricultural products and a VBP of USD 50,854,709 are predicted for 2021.

In the industry sector, the Nova Serrana footwear cluster in Minas Gerais is developing well with financial and technical support from the IDB, FIEMG, Government of Minas Gerais, and SEBRAE. The training courses are carried out by SENAI (National Service for Industrial Learning) and Sindinova (Intermunicipal Union of the Footwear Industry of Nova Serrana).  Nova Serrana and the surrounding region have around 1,200 shoe factories (99% are micro and small industries), which generate around 20 thousand direct jobs and at least another 23 thousand indirect jobs. Currently, local production is 105 million pairs of women’s and sports shoes per year, producing an average of 800 pairs per day per company.

Nova Serrana and the surrounding region have around 1,200 shoe factories (99% are micro and small industries), which generate around 20 thousand direct jobs and at least another 23 thousand indirect jobs. Currently, local production is 105 million pairs of women’s and sports shoes per year, producing an average of 800 pairs per day per company.

In 2017, the Government of Minas Gerais, through the Extraordinary Secretariat for Integrated Development and Regional Forums (Seedif), and SEBRAE signed an agreement with 11 municipalities in Minas Gerais to guarantee support for 14 LPAs. The total amount was 55 thousand USD. Fruticultura de Jaíba and the footwear cluster from Nova Serrana were also considered. While this financial support is not large, clusters still obtain funding from organizations such as SEBRAE and other policy funding sources. These clusters help economic growth by improving human resource training, expanding the market, reducing costs, and improving production technology.

In the technology sector, the Curitiba software cluster in Paraná greatly helps the region’s economic development. This cluster aims to strengthen and streamline the relationships, products, and services of companies producing software and systems in Curitiba, increasing business, creating jobs, and investing in innovation. The supporting institutions are the Government of Paraná, state universities in partnership with the Federation of Industries of Paraná (Fiep), and SEBRAE. In 2012-2016, with an average growth of 20% to 30% per year, the technology sector employed 18 thousand people throughout Paraná, increasing the number of jobs by 75%. According to data presented by the Curitiba Agency in 2019, Curitiba was ranked first in terms of productivity and efficiency in the technology sector in Brazil, with a rate of USD 21 thousand per worker. In 2020, Curitiba was ranked fifth in the number of startups among the capitals, and fourth place nationally in terms of quantity and quality of technological ventures. The establishment of a cluster helps companies in Paraná to prepare for integration and competition in the foreign market, creating conditions for internationalization. In addition, the software cluster transforms Curitiba into a smarter city, enhancing the innovation ecosystem. In 2020, Curitiba was selected by the Intelligent Community Forum (ICF) as one of the 21 Smartest Cities in the World of 2020, among cities like Philadelphia (USA), Adelaide (Australia), and Winnipeg (Canada).

Cluster development in China

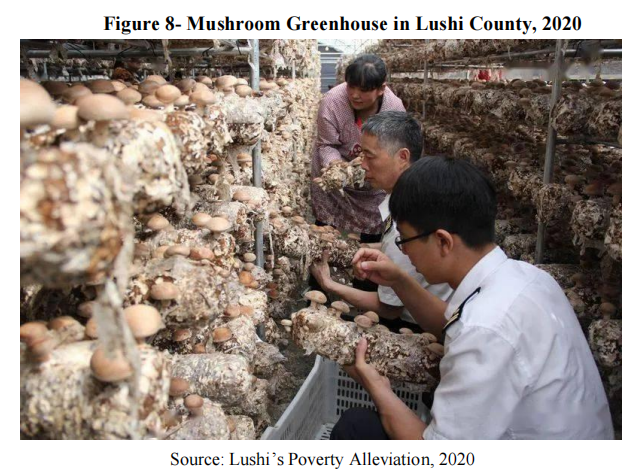

In the agriculture sector, the Mushroom Cluster in the Sanmenxia City of Henan Province is one of the 50 benchmark clusters in China. As the main county in this cluster, Lushi County has established a standardized technical system for mushroom production, carrying out the industrialization and standardization of production. According to statistics, there are about 20 mushroom and related products export companies in Lushi County, and the annual mushroom export value exceeds USD 0.15 billion. The goal by the end of the “Thirteenth Five-Year Plan (2016-2021)”, is to develop more than 3,000 standard mushroom greenhouses, promote the development of high-quality mushrooms, reduce poverty, help more than 10,000 poor families sustainably increase their incomes, and increase the average annual family income by more than USD 4,620.

In the agriculture sector, the Mushroom Cluster in the Sanmenxia City of Henan Province is one of the 50 benchmark clusters in China. As the main county in this cluster, Lushi County has established a standardized technical system for mushroom production, carrying out the industrialization and standardization of production. According to statistics, there are about 20 mushroom and related products export companies in Lushi County, and the annual mushroom export value exceeds USD 0.15 billion. The goal by the end of the “Thirteenth Five-Year Plan (2016-2021)”, is to develop more than 3,000 standard mushroom greenhouses, promote the development of high-quality mushrooms, reduce poverty, help more than 10,000 poor families sustainably increase their incomes, and increase the average annual family income by more than USD 4,620.

The model combines cooperation between leading companies, cooperative agencies, production bases, and farmers. The government offers different preferential conditions for each party, such as:

- For leading companies with an annual production of more than 20 million mushroom mycelium seedlings or annual production value of super-processed mushrooms in excess of USD 9.3 million, there are four support measures including state investment, preferential loan, exemption from facility fee, and policy priority.

- For cooperative agencies and production bases, the local government provides reward subsidies (the amount of subsidy depends on the quality and speed of development).

- For farmers, the government offers preferential loan terms such as exemptions from guarantees and mortgages and interest subsidies, guaranteeing the low-cost price and minimum selling price of the mushrooms.

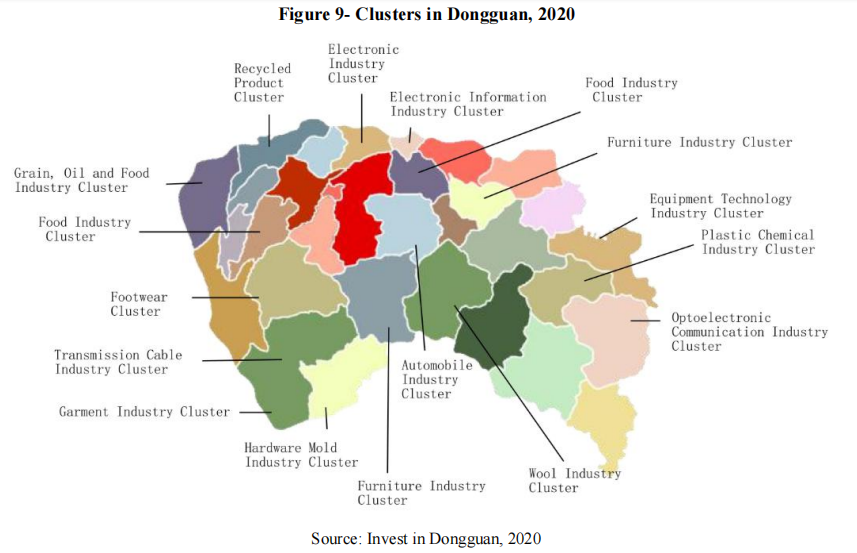

In the industry sector, the food and beverage, textile and clothing, and furniture clusters in the Dongguan City of Guangdong Province are among the most developed industrial clusters in China. Dongguan government has launched special funds totaling USD 70 million per year, including funds for traditional industry automation transformation projects, growth awards for leading companies in traditional industries, and new benchmarking of industrial cluster development projects. This fund aims to complete 80 automation transformation projects in 2021 and increase the growth rate of industrial value-added in the three main industries compared to 2020. In addition, the local government has also signed the Framework Agreement for Strategic Cooperation for the Development of Strategic Industrial Clusters with the China Construction Bank to provide at least USD 77 billion in comprehensive financial services to companies in Dongguan’s industrial clusters.

In the industry sector, the food and beverage, textile and clothing, and furniture clusters in the Dongguan City of Guangdong Province are among the most developed industrial clusters in China. Dongguan government has launched special funds totaling USD 70 million per year, including funds for traditional industry automation transformation projects, growth awards for leading companies in traditional industries, and new benchmarking of industrial cluster development projects. This fund aims to complete 80 automation transformation projects in 2021 and increase the growth rate of industrial value-added in the three main industries compared to 2020. In addition, the local government has also signed the Framework Agreement for Strategic Cooperation for the Development of Strategic Industrial Clusters with the China Construction Bank to provide at least USD 77 billion in comprehensive financial services to companies in Dongguan’s industrial clusters.

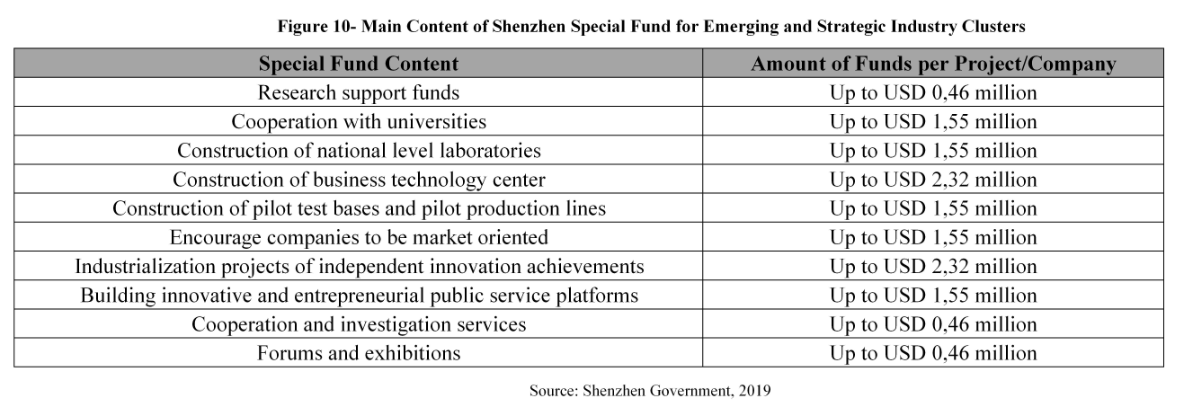

In the technology sector, the strategic emerging industrial cluster in Shenzhen City of Guangdong Province is the most representative of good policy implementation and economic growth. The Shenzhen Government launched the policy of support with special funds for the development of strategic emerging industries. The Shenzhen Bureau of Information and Industrial Technology has announced the list of projects to be funded by the digital economy industry support plan in 2021. A total of 159 projects are on the list, involving a total of about USD 41 million.

Recommendations

From the experiences of Brazil and China, we can extract the following best practices and recommendations for Portuguese-speaking African countries.

- Encourage cluster policies as they are relevant to the local development of an emerging country and complementary to value chain or horizontal policies.

- As for any development policy, cluster policies must be continuous and evolve every 5-10 years, making them effective instruments of transformation and facilitating the execution of horizontal policies (quality, productivity, exports, innovation) according to the trend of national development.

- Involve all support institutions present at the local, regional or national levels in the cluster. These institutions remain embedded in the cluster and their participation will sustain its development. This is also in the self-interest of the institutions, allowing them to benefit through direct access to the companies. Examples are in training, financing, education, or research and innovation.

- Provide adequate incentives for cluster participants, including business, academia, and the public sector. Companies need knowledge and actions that truly improve their competitiveness; academia will be able to adapt its curriculum and obtain better results in the areas of R+D+i; the public sector will have results to show in terms of economic and social impact.

- Combine national planning with regional or city policy, balancing high-level design and implementation according to local conditions.

- Have a general methodology and a long-term vision of the future for each cluster, will help to propel all parties in the same direction.

- Encourage cooperation at the government level, connect with other countries and promote the exchange of ideas for learning.

- Encourage institutions and think tanks to create an African cluster cooperation network.

Conclusion

In order to offer cluster policy recommendations for Portuguese-speaking African countries, we have compared distinct socio-economic realities in this article, using as references Brazil and China, countries with strong economic standing and high growth potential. Compared to the initial stages in Portuguese-speaking countries in Africa, Brazil developed its cluster policy with the objective of regional development and had a structured national policy for 10 years, while China had a very structured policy, long-lasting, well-financed, and with the aim of accelerating economic transformation and rapid gains in competitiveness.

The Brazilian model is focused on the sustainable development of territories, supporting economic entities to be competitive in the national and international market. The Chinese model is characterized by strong financial support from the government to encourage companies with good results and continuity of policies, seeking integration in global chains. Both in Brazil and in China, the cluster is an economic tool that serves as a platform for communication and the execution of structured actions, demonstrating that they play an essential role. Cluster policies that are well-structured, well-financed, long-standing, and with the right incentives will give better results.

Due to the development stage of clusters in Portuguese-speaking African countries, there is great potential for cooperation between these countries, Brazil and China at the level of companies, academic institutions, and governments. In fact, countries with more mature development, such as Brazil and China, could also exchange experiences and combine best practices.

We hope that in some way, this article can help countries develop and construct their cluster policies.